Support to Entrepreneurs

MUDRA Loan Scheme Guide for Small Businesses (How to Apply)

High interest rates, long paperwork, and collateral demands stop many small businesses before they start. If you have a solid idea but no security to pledge, there is a simpler path.

The MUDRA loan scheme, under the Pradhan Mantri Mudra Yojana (PMMY), offers collateral‑free loans up to Rs. 10 lakh for micro enterprises in trading, manufacturing, and services. It was built to back entrepreneurs on the ground, with a strong push for women and marginalized groups who often face the biggest funding gaps.

This guide breaks down who qualifies, what you can use the funds for, and how the three loan categories work. You will also see the key benefits, the documents you need, and step‑by‑step application tips so you can apply with confidence.

Expect plain answers, lender‑ready checklists, and practical advice you can use today. If you want a quick visual primer before you read, this video helps

By the end, you will know how to pick the right category, avoid common mistakes, and submit a clean application. Getting funded should not feel out of reach. Let’s make the MUDRA loan scheme work for your business.

Jump Into

What Is the MUDRA Loan Scheme and Why It Matters for Small Businesses

The MUDRA Loan Scheme supports micro businesses that need funds without pledging assets. It backs traders, service providers, and small manufacturers with collateral-free credit up to Rs. 10 lakh. Some lenders also list Tarun Plus options up to Rs. 20 lakh. You apply through banks, NBFCs, MFIs, or small finance banks. For official details on coverage and lenders, check the Mudra portal.

Think of it as a flexible ladder. You start small, build a track record, and move up as your business grows. The goal is simple: help you buy inventory, add equipment, hire staff, or expand a service without heavy paperwork or security.

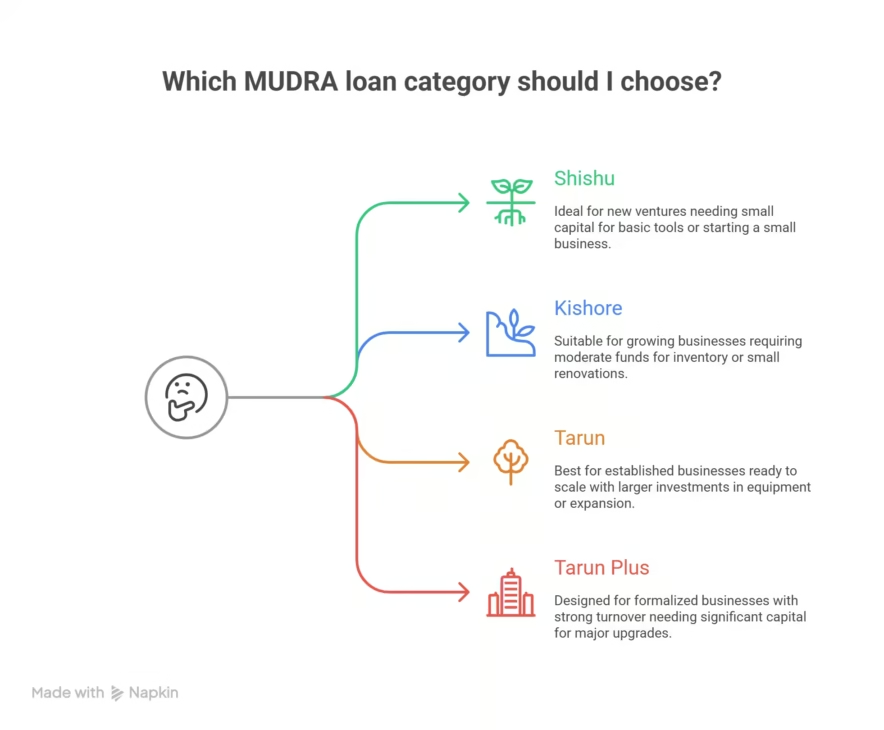

The Three Main Loan Categories Under MUDRA

Here is a quick comparison to help you choose the right fit. All categories are collateral-free.

| Category | Loan Amount | Best For | Typical Uses | Collateral |

| Shishu | Up to Rs. 50,000 | New ventures or very early stage | Starting a tea stall, mobile repair kiosk, buying basic tools | Not required |

| Kishore | Rs. 50,001 to Rs. 5 lakh | Growing businesses with some revenue | Bulk inventory, a second hand machine, small renovation | Not required |

| Tarun | Rs. 5 lakh to Rs. 10 lakh | Established businesses ready to scale | New outlet, modern equipment, vehicle for deliveries | Not required |

| Tarun Plus (where offered) | Up to Rs. 20 lakh | Formalized businesses with stronger turnover | Larger expansion or upgrade needs | Not required |

How it fits different stages:

- Shishu suits a first step. Example: opening a small kirana or salon corner.

- Kishore helps you stabilize. Example: increasing stock, adding a sewing machine, or moving to a slightly larger space.

- Tarun is for scale. Example: adding a delivery vehicle or a new branch for your service.

- Tarun Plus is available through select platforms and lenders. See the government-backed flow on Jansamarth for PMMY.

Quick tips to choose:

- Start with the smallest category that covers your plan.

- Match ticket size to a clear revenue path. Do not overborrow.

- Check lender terms, processing time, and any category-specific conditions on the Mudra offerings page.

With the MUDRA loan scheme, you can pick a category that mirrors your stage, prove repayment with steady cash flow, then move up as your business grows.

Eligibility Criteria: Who Qualifies for a MUDRA Loan

Not sure if you qualify for the MUDRA loan scheme? Here is a clear, no-jargon checklist. If you run or plan to start a small business in trading, services, or manufacturing, you are likely eligible.

- Eligible borrowers: Individuals, sole proprietors, partnership firms, small companies, and micro enterprises. New and existing units can apply.

- Business type: Non-farm, non-corporate micro enterprises only. Agriculture allied activities like dairy, poultry, and fishery are allowed.

- Loan size: Up to Rs. 10 lakh under Shishu, Kishore, and Tarun. Some lenders list Tarun Plus up to Rs. 20 lakh.

- Purpose of loan: Working capital or term loan for inventory, tools, machines, renovations, vehicles, or expansion.

- Age and citizenship: Applicant should be an Indian citizen, typically 18 to 65 years, with basic KYC and address proof.

- Financials: A viable business plan and healthy cash flow. No major loan defaults in credit history.

- Collateral: Not required. Coverage is supported through credit guarantee.

- Lenders: Scheduled commercial banks, small finance banks, regional rural banks, NBFCs, and MFIs that are enrolled on the scheme.

- Sector exclusions: Activities banned by law or speculative in nature are not eligible.

For a quick reference on categories and coverage, review the official breakdown on the Mudra offerings page.

Tip to boost approval:

- Keep a simple project report and a month-by-month use of funds.

- Show sales records, GST returns, or bank statements to back cash flow.

- Match your ask to the relevant category to avoid overborrowing.

Special Focus on Women and Underprivileged Entrepreneurs

The MUDRA Loan Scheme is built to be inclusive. It has a strong track record of funding women-led and underrepresented businesses across India.

- Women-led growth: Government data in 2025 shows women account for about 68 percent of total MUDRA beneficiaries. This reflects high acceptance in retail, services, and home-based manufacturing, and a steady rise in average ticket size. See highlights in the government press note, A Decade of Growth with PM Mudra Yojana, from the Press Information Bureau: women beneficiaries at 68 percent.

- SC, ST, and OBC participation: Around half of MUDRA accounts belong to SC, ST, and OBC entrepreneurs, pointing to wide access beyond metro centers.

- What this means for you: If you are a woman or belong to SC, ST, or OBC categories, your application sits within a priority segment that lenders actively support.

Common advantages you may see at the branch level:

- Higher acceptance rates for women applicants, especially with a clear plan and local trade references.

- Relaxed margin money and quicker processing in many branches for women, SHGs, and first-time borrowers.

- Subsidy linkages or interest support may apply when combined with state or livelihood programs, based on lender and location.

- Dedicated desks or nodal officers for women and social category applicants at select banks.

Practical pointers:

- Add proof of category where relevant, such as SC/ST/OBC certificate or SHG membership. It helps banks tag your account correctly for priority processing.

- Keep your ask realistic for your stage. For first-time borrowers, Shishu or Kishore often gets a faster yes.

- Use official success stories for inspiration and to understand loan use cases. Explore women-led case studies on the Mudra Women stories page.

Bottom line, inclusion is not a footnote in this scheme, it drives it. The numbers from 2025 clearly show that women and underprivileged entrepreneurs are not on the sidelines, they are front and center in the MUDRA loan scheme’s growth story.

Benefits of the MUDRA Loan Scheme for Your Business Growth

Growing a small business often hinges on timely, affordable credit. The MUDRA loan scheme makes that possible with simple eligibility, no collateral, and wide lender access. Here is how it helps you move from idea to steady growth.

Financial Advantages

- Collateral-free credit up to Rs. 10 lakh, so you keep your assets safe. The coverage is supported by the CGFMU guarantee, which reduces lender risk and speeds approvals. See guarantee details on SBI’s PMMY page: CGFMU backed coverage.

- Flexible ticket sizes for every stage, from Shishu to Tarun. You borrow only what you need and grow step by step.

- Lower entry barriers with simple KYC and a lean document set, compared to standard SME loans.

- Working capital or term loan options, so you can fund stock, equipment, or expansion without juggling multiple products.

- Competitive interest rates, since many banks and NBFCs price PMMY loans to scale with risk and category.

Operational Advantages

- Quick processing at banks, small finance banks, NBFCs, and MFIs that are enrolled under PMMY.

- Use-of-funds flexibility, covering inventory, tools, machines, shop fitouts, and vehicles. The official summary highlights diverse use cases across retail, services, and micro manufacturing: MUDRA benefits overview.

- Refinance support to lenders, which helps keep supply of credit steady across districts and small towns. Learn how refinance works on the Mudra offerings page.

- No margin money in many cases, or a small margin only, which keeps your cash free for operations.

- Simple renewal paths when you maintain repayments, making future top-ups faster.

Growth and Inclusion Advantages

- Start small, build a track record, and move from Shishu to Kishore to Tarun with clean repayments.

- Women-first momentum, with strong participation and supportive branch policies across India.

- Coverage for new and existing units, so first-time founders and growing shops both benefit.

- Wide sector reach across trading, services, and manufacturing. The official PMMY listing shows allowable activities and limits: myscheme PMMY details.

- Job creation on the ground, since funds go straight into tools, stock, and local hiring.

Practical Wins You Can Expect

- Faster yes when your project report is clear and realistic.

- Better cash flow after switching daily supplier credit to a structured working capital line.

- Cleaner books when you use one loan for purchases and keep vendor payments on time.

- Easier upgrades like buying a second-hand machine, adding a station, or opening a kiosk.

Quick Examples

- Salon owner, Kishore: Buys two chairs and a dryer, doubles seat capacity, and boosts weekday revenue.

- Mobile repair shop, Shishu: Stocks spare parts and tools, cuts turnaround time, and increases repeat customers.

- Tiffin service, Tarun: Adds a delivery vehicle, expands routes, and locks in bulk corporate orders.

Keep it simple: match the loan category to your current stage, borrow only what your cash flow supports, and use each upgrade to lift monthly revenue. That is how the MUDRA loan scheme turns small steps into steady growth.

How to Apply for a MUDRA Loan: A Simple Step-by-Step Guide

A clean application moves faster. Map your loan need, pick the right category, and attach the exact documents your lender expects. The MUDRA Loan Scheme keeps it simple, but details still matter. Use this section to get your paperwork right and avoid easy mistakes that lead to delays.

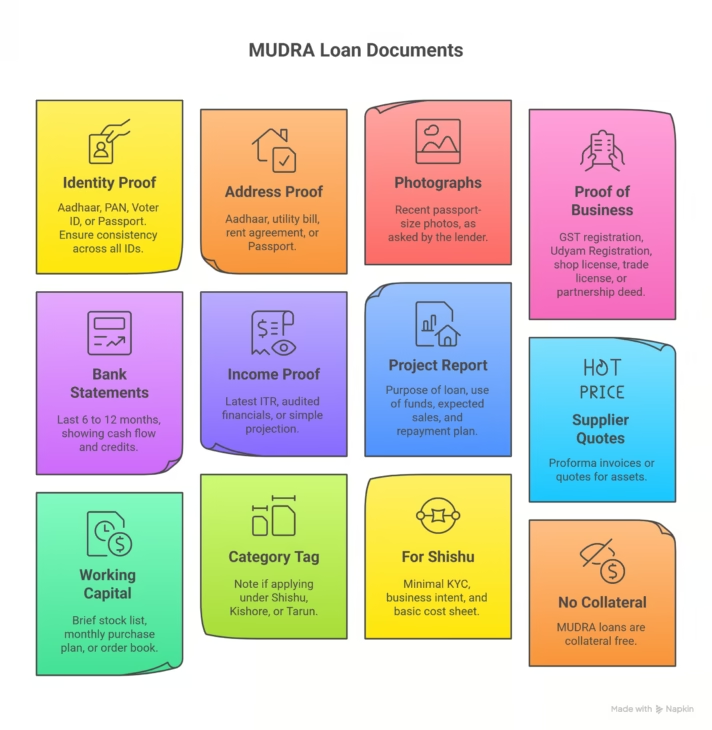

Essential Documents Needed for Your MUDRA Loan Application

- Identity proof: Aadhaar, PAN, Voter ID, or Passport. Keep names and addresses consistent across all IDs.

- Address proof: Aadhaar, utility bill, rent agreement, or Passport.

- Photographs: Recent passport-size photos, as asked by the lender.

- Proof of business: GST registration, Udyam Registration, shop and establishment license, trade license, or partnership deed. For proprietors, add any local license or registration that shows the business exists.

- Bank statements: Last 6 to 12 months, to show cash flow and regular credits.

- Income proof: Latest ITR if applicable, audited financials if available, or a simple projection for very small units.

- Project report or business plan: Purpose of loan, use of funds, expected monthly sales, and repayment plan. Keep it short and specific.

- Supplier quotes: Proforma invoices or quotes for machinery, tools, vehicle, or renovations if you are buying assets.

- Working capital need: Brief stock list, monthly purchase plan, or order book if relevant.

- Category tag: Note if you apply under Shishu, Kishore, or Tarun. Match ticket size to your stage.

- For Shishu: Minimal KYC, simple business intent, and a basic cost sheet often suffice.

- No collateral documents: MUDRA loans are collateral free, so you do not need property papers.

- Keep everything updated: PAN-Aadhaar linking, address, mobile number, and bank KYC must be current.

- For reference, see document guidance on the official portal: MUDRA documents list.

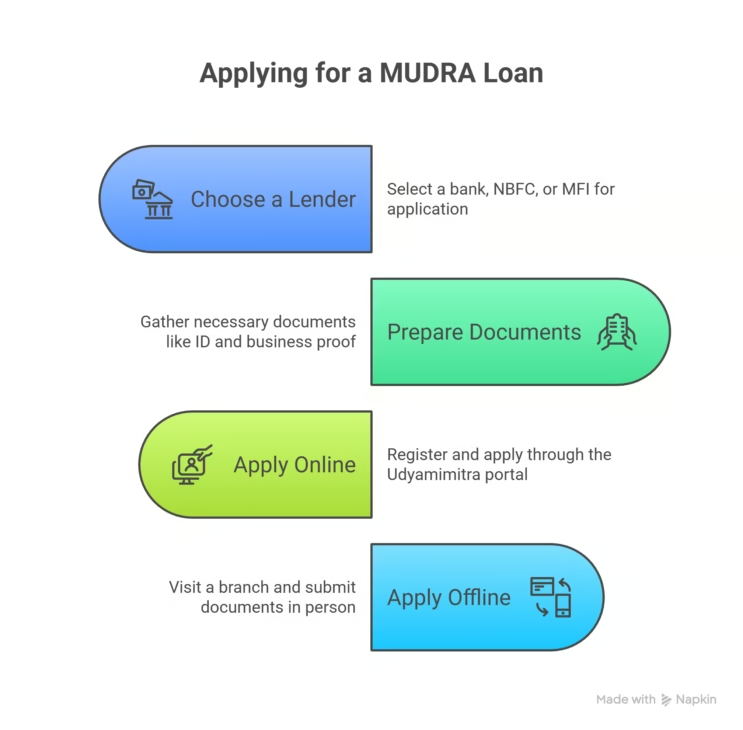

How to Apply for a MUDRA Loan (Simple Steps)

- Choose a Lender

Apply through a bank, NBFC, MFI, or directly on the Udyamimitra portal. - Prepare Documents

Keep ready:

- ID & Address Proof (Aadhaar, PAN, Voter ID, etc.)

- Business Proof (Udyam/GST/Shop license)

- Bank Statements & simple business plan

- Supplier quotes (if buying machines/equipment)

- Passport-size photos

- Apply Online or Offline

Apply Online

- Visit: Go to the Udyamimitra portal (www.udyamimitra.in).

- Register: Register by providing your email and mobile number to generate an OTP.

- Complete Application: Fill in your personal and professional details.

- Submit: Select a lender or hand-holding agency if needed and submit your loan application.

Apply in Person

- Contact Lender: Visit a nearby branch of a chosen bank, NBFC, or MFI.

- Submit Application: Submit the completed loan application form and all supporting documents to the financial institution for processing.

Common Mistakes and Reasons for Rejection (And How to Avoid Them)

- Incomplete business plan: Lenders need a clear plan, not just an idea. Show what you will buy, how it adds revenue, and monthly repayment from cash flow. Add a simple payback math.

- Poor credit history: MUDRA is flexible, but past defaults or frequent delays can be a red flag. Pull your credit report, fix errors, and add a note on any settled accounts.

- Incorrect category selection: Asking for Tarun when you are still at Shishu stage signals risk. Align the amount with your current turnover and orders.

- Missing or incorrect documents: Skipping KYC, old addresses, or mismatched signatures triggers rework. Use a checklist and cross-verify names, dates, and totals.

- Unrealistic sales projections: Overstated numbers hurt trust. Base projections on last 3 to 6 months of bank credits or verifiable orders.

- Weak bank statement hygiene: Heavy cash withdrawals and bounced payments raise concerns. Clean up 60 to 90 days before applying.

- Large existing obligations: High EMIs and low net income reduce approval odds. Consider a smaller ask or step-up plan from Shishu to Kishore.

- For broader context on why lenders reject business loans and how to fix it, review this explainer: Top reasons lenders reject business loan applications.

Set yourself up for a quick yes. Keep documents crisp, pick the right category, and root your plan in real numbers. The MUDRA Loan Scheme rewards clarity and consistency.

FAQ – MUDRA Loan Scheme

Got questions about the MUDRA Loan Scheme? Use this FAQ to clear doubts fast. Each answer is short, practical, and based on what lenders actually ask for during screening.

Who can apply for a MUDRA loan?

Any Indian citizen running or starting a non-farm micro enterprise can apply. This includes individuals, sole proprietors, partnership firms, small companies, and SHG members. Both new and existing units are eligible. For a quick official overview, see the scheme FAQs on the Mudra portal: MUDRA FAQs.

What are the loan categories and limits?

Loans are offered in three slabs under PMMY:

- Shishu: up to Rs. 50,000

- Kishore: Rs. 50,001 to Rs. 5 lakh

- Tarun: Rs. 5 lakh to Rs. 10 lakh

Some lenders list higher tickets under their own policies, but the standard PMMY cap is Rs. 10 lakh. Official FAQs explain the structure and use cases here: PMMY FAQ by PIB.

Is collateral required?

No, MUDRA loans are collateral free. Lenders extend credit based on business viability, KYC, and cash flow. The scheme is supported by a credit guarantee to reduce lender risk. You can confirm this in the official FAQ: PMMY FAQ by PIB.

What can I use the funds for?

Use the loan for income-generating activities in trading, services, and micro manufacturing. Typical uses include:

- Inventory and working capital

- Tools, machines, equipment, or a small vehicle

- Shop renovation and basic fitouts

- Business software or small IT assets

Non-farm activities are covered, and allied agriculture like dairy or fishery is usually allowed. See the activity scope on the official portal: Pradhan Mantri Mudra Yojana overview.

How do I apply?

You can apply at a nearby branch of a bank, small finance bank, RRB, NBFC, or MFI that participates in PMMY. Many lenders accept walk-ins with a simple form, KYC, and a short project note. The Mudra portal explains where and how to apply: Mudra official site.

What interest rate will I get?

Rates are set by each lender, based on risk, category, and internal policy. Expect pricing to reflect your business cash flow, credit profile, and the loan type, term loan or working capital. Ask the branch for the current grid before you submit your file.

Are there processing fees or hidden charges?

Fees vary by lender and ticket size. Some lenders waive processing for Shishu. Others apply a small fee for Kishore and Tarun. Ask for a written break-up, processing, insurance if any, and documentation charges, before accepting the sanction.

What documents do I need to keep ready?

Keep KYC and simple business proofs handy. A clean, short file speeds up approvals.

- Identity proof and address proof

- Recent photos

- Basic business proof, Udyam, GST, trade license, or shop license

- Last 6 to 12 months bank statements

- ITR or a simple income note if applicable

- Project report with loan purpose, cost, and repayment plan

- Quotes for assets, equipment, or renovations For a lender-style checklist, review this bank FAQ: FAQ on MUDRA Loans, Indian Bank.

Can I apply as a first-time entrepreneur?

Yes. First-time founders can apply, especially under Shishu or Kishore. Keep the plan simple, tie the ask to a clear revenue path, and attach vendor quotes or an order book if available. Lenders prefer realistic numbers over big projections.

Will my credit score affect approval?

There is no fixed score across all lenders. A clean repayment record, low existing EMI load, and steady bank credits help. If you have past delays, add context in writing and show current discipline through recent statements.

Is there a moratorium on repayments?

Many lenders allow a short moratorium for term loans while assets are installed and revenue starts. The duration and terms depend on the lender and the activity. Ask for this at the proposal stage, not after sanction.

Can I use a MUDRA loan to repay old debt?

PMMY is meant for productive use and business growth. Most lenders will not allow using the funds to repay existing borrowing. Focus the proposal on new assets, stock, or working capital that drives cash flow.

How long does approval take?

Timelines depend on lender workload, the loan category, and how complete your file is. Clean files often move faster. Follow up every few days and respond quickly to any document requests.

Are there subsidies under PMMY?

MUDRA loans do not carry an interest subsidy by default. The scheme provides collateral-free credit with a guarantee backstop. Some state programs or livelihood schemes may add benefits, based on location and eligibility. For policy basics, see the official FAQ: PMMY FAQ by PIB.

Any quick example to guide my ask?

- Example: A home-based tailor seeks Rs. 1.8 lakh under Kishore to buy two sewing machines, add fabric stock, and a cutting table. Monthly EMI fits within current orders plus expected walk-in sales. Vendor quotes and a simple three-line sales projection are attached. This is a clean, lender-friendly file.

Still unsure about a detail? Cross-check direct from the source here: MUDRA FAQs.

Conclusion

You now have a clear map to get small business credit that is simple, collateral free, and geared for growth. Pick the category that matches your stage, size the ticket to your cash flow, and attach clean, lender ready documents. Start with what you can repay, then build a steady record and step up as your revenue grows.

Check your eligibility today, then apply through a trusted bank, small finance bank, NBFC, or MFI. For official guidance, visit mudra.org.in, or walk into your local branch with your KYC, basic business proof, bank statements, and a short project note. If your plan is focused and numbers are realistic, approvals move faster and renewals get easier.

India’s micro firms power jobs and local demand, and this is your turn to move forward in the 2025 economy. Keep your plan simple, keep your books clean, and put the funds to work where they raise monthly sales. The MUDRA loan scheme can be the nudge that turns today’s idea into tomorrow’s steady business.